Project

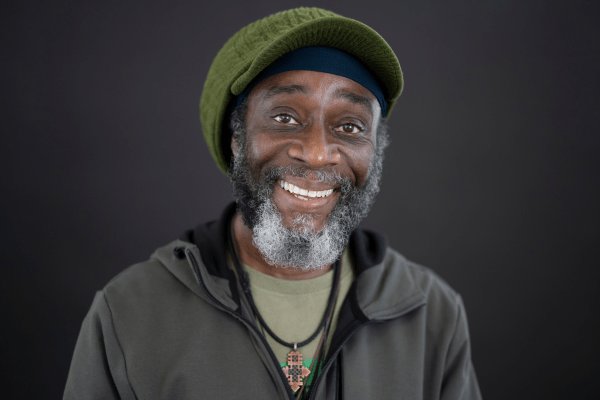

“Accessing funds was critical for us to continue on our journey,” says Peter. But raising investment was a new step for Peter and his team: “This opportunity was a first for us.”

After discussions with social investor CAF Venturesome, SWIM was referred to the Reach Fund, which supports small social enterprises and charities in England to prepare for social investment. A grant from the Reach Fund meant that SWIM could take on a consultant to help it to become investment ready.

Peter knew Eastside People from a previous project, and they were a perfect choice for this project. “Eastside People understands the space in which we work, our concerns and the relationships with the organisations we are connected to. They also have the experience needed to help clients meet the stringent good governance, due diligence and data requirements made by funding organisations such as CAF Venturesome,” he says.

Solution

Eastside People’s role was to develop a financial forecast to demonstrate that SWIM could support a loan, and that its ambitions for growth were realistic. Additionally, social investors require investees to have strong governance, so SWIM’s structure was reviewed including analysis of potential conflicts of interests and a review of the SWIM board of directors.

“We didn’t know the kind of information, the quality of information and the depth of information that would suffice,” says Peter. “Eastside People’s previous experience took out the angst from our perspective and brought simplicity to the process.”

He adds: “We are a relatively young, but growing organisation. The experience of working with Eastside People and CAF Venturesome has given us a greater understanding of the importance of strong governance and financial transparency to help us attract new contracts and funding.”

Peter also highlights Eastside People’s commitment to the project. “They had a real belief and a desire to make this happen. They were fast and very supportive, and easy to work with,” he says.

As a result, in summer 2022 SWIM was awarded its biggest funding injection to date: £110,000. This blended finance package from CAF Venturesome was made up of a £77,000 loan and £33,000 grant.

This investment has launched SWIM into its next phase of expansion. Peter recruited new members of staff, including a business development manager, finance manager and frontline staff.

“The most significant part of this is the creation of more business,” says Peter. “We have been successful in winning bids in other boroughs and with new partners and there are more bids going in.”

“SWIM is doing amazing work,” says Eastside People’s Jo Simpson. “I hope this first investment will be a real accelerator.”

Social Investment funds the SWIM Housing project

As a result of this success, Peter started planning SWIM’s next steps. With the support of Eastside People, he sought more social finance to back a housing project.

The reason for prioritising housing is because many of SWIM’s client group have exited from the prison system or from mental health services. With 70% to 80% having experienced some sort of homelessness, rough sleeping or sofa surfing, housing and accommodation is their biggest challenge. Safe and good quality accommodation is a basic requirement at the start of any rehabilitation process so the next step in SWIM’s strategic objectives was to build their housing and homeless offer.

Now that the organisation had a skilled team in place, they could begin to put together the plan needed to acquire a mortgage to buy their first property. The SWIM team (together with some financial planning support from Eastside People), prepared a proposal to a number of social investors including Charity Bank. an ethical bank that uses its savers’ money to lend to charities and social enterprises.

As this was the 1st time that the team from SWIM had tried to apply for a mortgage, it was very important to them to find a helpful provider.

“The experience of working with Charity Bank was relatively smooth, they had a real willingness to make it work, being flexible with their processes and finding ways to make sure that we could navigate our way through their requirements, finding solutions instead of presenting obstacles. This was definitely not the case with some of the other investors that we approached.” said Peter.

SWIM acquired their 1st property (a high quality 5 bedroom house in Newham) early in 2023, raising £530K through social finance and grants which now houses a thriving community of residents.

As a result of the initial investment by Charity Bank, they have developed a portfolio of 5 properties with 25 individual units and they have worked with both Hackney and Newham local authorities together with the Greater London Authority (GLA) to deliver supported accommodation and support services across 31 units. SWIM manage and own 11 of these units with 20 managed by a housing association.

“These brilliant partnerships with our 2 local authorities came about because they were able to see the success and outcomes we were able to achieve after our 1st round of social investment and they could see the value that a black-community-led social enterprise would add to delivery of services in their local areas”. Peter adds.

Peter has big ambitions for SWIM. “I’ve always felt compelled to give back what was given to me,” he says. “I need to see more people of colour achieve recovery.”

The next step in the journey for SWIM is to purchase a redevelopment site in Hackney in partnership with a local authority to re develop into up to 10 residential units (of which some would be temporary accommodation for the local authority, and some directly managed by SWIM.

They are in negotiations with a number of investors for funding for this including Charity Bank, city charity investors and the Greater London Authority for a sum of up to £3m.

The importance of consultancy

Before engaging with Eastside People, SWIM had no experience of putting together a structured package for funding. Peter says that by working with the social investment team from Eastside People, they moved from a state of ‘unconscious competence’ to one of ‘conscious competence’. The Eastside People consultants knew exactly what they were doing and also the fact that they knew all the financial stakeholders helped the team from SWIM to identify skills gaps, structure their proposals and manage the relationships.

Lessons learned

When asked what advice he would give to other charities or social enterprises looking to embark on the social investment journey Peter said:

“Absolutely believe in yourself, you must have resilience and persistence but do not be knocked off course. Absolutely expect knock backs so you’ll need to learn how to bob and weave.

Surround yourself with people who are cleverer than you, our relationship with Eastside People was a key part of the story.”

We’re a Pioneer’s Post and NatWest SE100 Social Investment Pioneer with SWIM

So proud to be recognised by Pioneers Post & NatWest Social and Community Capital in their SE100 2024 as a ‘Social Investment Pioneer’ for the work that our Social Investment & Investment Readiness consultancy team is doing with Peter Merrifield and his team at SWIM. Read the full details here.