Blog: Charity round table – Mergers for Sustainability and Diversification: Types of charity mergers & their benefits.

This excerpt is from our charity merger round table which was held on 4th December 2024. The round table was attended by CEOs and leaders of charities and not-for-profit organisations who were interested in learning more about the best practices and opportunities from merger.

The speakers were:

- Cara Evans, Head of Partnerships and Mergers at Eastside People

- Jo Land, Group CEO Avenues Group

- Karina Hourd, Group Director of Business Development, Avenues Group

- Ricardo Gomes da Silva General Counsel & Director of Systems, Family Action

- Steve Chu, Eastside People Consultant and merger expert.

A big thanks must go to our guest speakers, Jo Land, Karina Hourd and Ricardo Gomes da Silva who stepped in at the last minute to offer their amazing advice and tips after our previously confirmed speaker had a family emergency.

Cara Evans opened with a short presentation outlining what we are seeing in the marketplace, the potential benefits of partnerships and mergers and the different types of merger. Cara noted that we had seen a 70% increase in merger leads over the last few months and a 30% increase in operational merger projects. In addition, we have seen a growing interest in merger search projects where our consultants work with charities to help them identify potential partners.

This significant increase in activity is driven by 3 main factors:

- Small charities looking for a home perhaps because they are in financial difficulty or as part of a plan for longer-term sustainability

- Charities that are already working together and now thinking about merging

- Big charities thinking of ways to grow inorganically or through diversification and wanting to identify suitable partners.

What are the benefits for charities of strategic partnerships and mergers?

- Greater profile and voice for campaigns

- Diversify funding and income sources

- Improve and enhance your talent pool (staff, volunteers, trustees, partners)

- Deliver economies of scale and back-office savings

- Create a continuum of services e.g. from young people to older people

- Improve and enhance services for beneficiaries

- Extend geographical or scale reach

- Enable service innovation.

Cara’s top tip is to consider what you want to achieve and what your ultimate outcome should be as a first step and find the right model for your merger once you have completed that process.

Charity Merger Challenges:

The challenges of going through a merger process should also be considered carefully.

- Resourcing and cost

- Loss of identity and mission

- Lack of specialist knowledge and skills within the organisation

- Finding potential partners

- Trust, sovereignty and the longer-term role of each individual in both organisations.

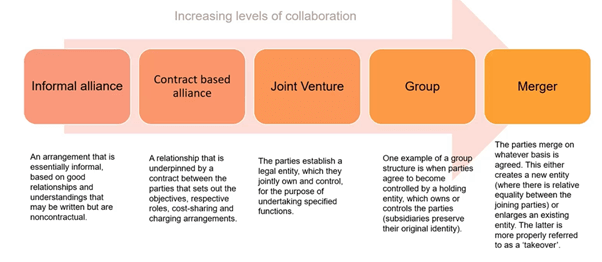

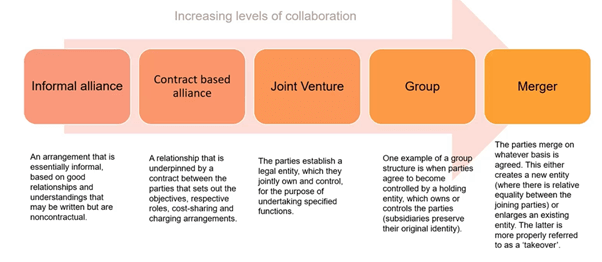

The charity merger collaboration spectrum: A merger relationship can range from an informal alliance to a full merger.

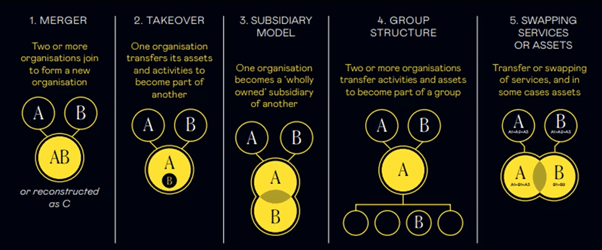

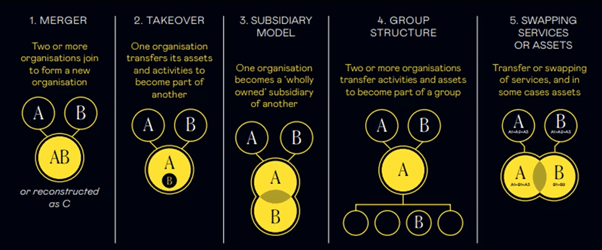

The 5 different types of charity merger

- Full Merger – when two or more organisations join to form a new organisation

- Takeover – where a transfer of assets and activities moves from one organisation to another

- Subsidiary Model – One organisation becomes a wholly-owned subsidiary of another

- Group Structure – Tow or more organisations transfer activities to become part of a group

- Swapping services or assets.

The 7 stages of a charity merger process

Stage 1: The option of merger is raised and discussed at board of the charity or not-for-profit

Stage 2: Identifying a suitable merger partner that would make a good match – search and approach. Developing a prospectus.

Stage 3: Boards agree to look in principle at the feasibility of merger. This feasibility study can take a few forms but should seek to look at key areas including:

- What are the practical steps to take in the event of a merger?

- What are the benefits/risks/challenges for our organisation around a merger?

- What are your ‘Reasons to Believe?’. You can create this document to outline the main reasons for the merger and use it to refer to both during and after the merger process to make sure you are still on track to achieve what you originally set out to do.

Stage 4: Due diligence – legal/other. This essential process is based on the key areas highlighted by the feasibility study. After the due diligence, boards decide, or not, to proceed with a merger (along with conditions to be met)

Stage 5: A detailed merger project plan is formed around each key area as appropriate (including communications and key dates)

Stage 6: A merger project plan is followed/updated/amended until the merger completes

Stage 7: Develop and execute a post-merger strategy process for ‘new’ organisation.

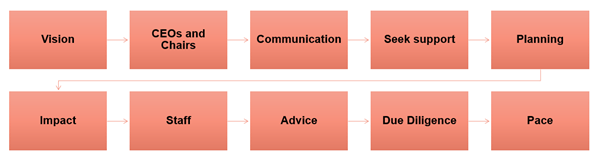

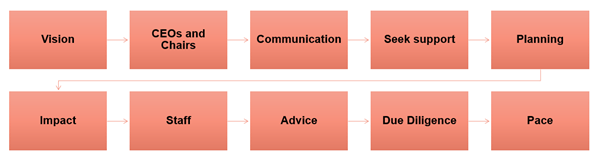

The key aspects of a successful charity merger

Read more about what makes a successful charity merger in Cara’s blog: Could merger be an option for your charity?

Find out more about our merger and partnership services for charities and not-for-profit organisations.