Successful mergers can have a transformative effect changing the scale, reach and prospects of an organisation and creating a better deal for the people that rely on a charity’s services. At Eastside People, we have been supporting charities and other not-for-profit organisations through partnerships and mergers for over a decade. In that time, we have witnessed organisations embark on partnerships and mergers for a myriad of reasons.

The Good Merger Guide was created by Eastside People to:

- Highlight the main questions to consider before embarking on a merger

- Provide step by step advice on the three stages of managing a merger.

We have taken some of the best advice and guidance from the Good Merger Guide focusing particularly on the practical and technical aspects of mergers. The 7 articles that make up the set are a must read for anyone in a charitable organisation considering merger as a possible option and wanting to know more about what is involved. This is article 3 of 7.

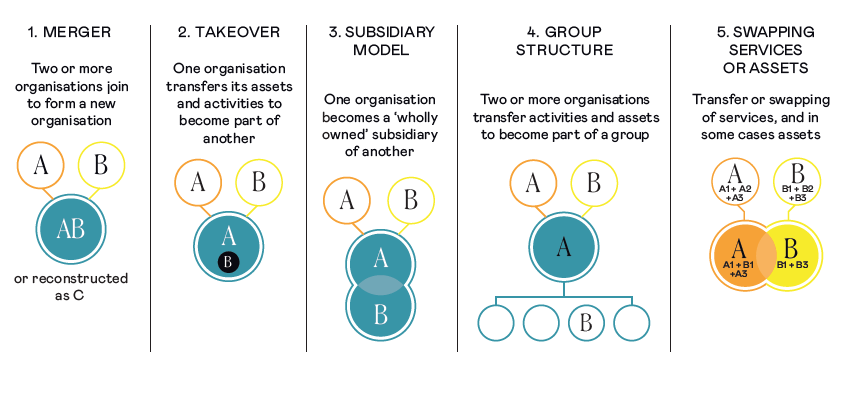

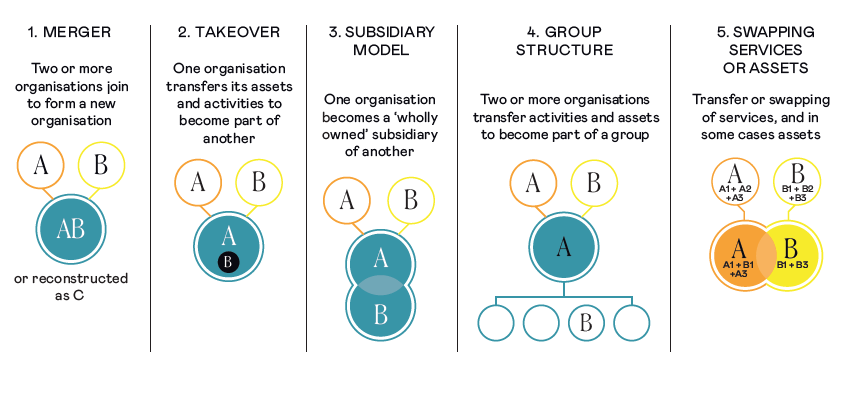

The 5 types of charity merger and the benefits of each

There is no definitive framework that outlines the different types of merger. At Eastside People, we use a framework based on Richard Gutch’s work, which is detailed in our Good Merger Guide, and which has since been adapted through peer review.

Often, when we are discussing the possibility of merger with a charity leader, they will want to discuss the different types of merger as a starting point. But remember, merger is a tool, not a strategy. We recommend that you first consider what it is that you want to achieve through merger. Only once that is clear, would we recommend exploring what merger model would best achieve that outcome.

In the charity sector, the word ‘merger’ can refer to a variety of transactions which bring together the assets and liabilities of two or more organisations in a number of different ways. A genuine merger of equals is relatively uncommon, but they do happen. In 2023-24, mergers of equals represented about 16% of all charity mergers. The most common type of transaction covered by the term ‘merger’ is a takeover and takeovers themselves come in different forms. (Models 2-4 below are all types of takeover).

Below, we provide an overview of the 5 types of ‘merger’ models, including their key characteristics and benefits.

The 5 Types of Charity Merger

1. Merger of Equals

Two or more charities combine to form a new entity.

Key characteristics:

- A new charity is established and takes on all the assets, liabilities, and operations of both (or all) the original charities

- Leadership and governance are typically restructured to represent both original charities

- Original charities are usually dissolved.

Benefits:

- Combines the strengths and resources of both organisations

- Avoids perception of one charity “taking over” the other

- Provides an opportunity to rebrand and reposition as a combined entity.

2. Takeover

In a takeover, one charity transfers its assets and activities into another charity, becoming part of that organisation.

Key characteristics:

- Generally, the larger charity receives all assets and liabilities of the smaller charity

- The smaller charity is typically dissolved

- Leadership and governance structures of the larger charity remain largely intact

- This can occur as a second phase of integration following an initial subsidiary model (see 3 below).

Benefits:

- Allows the smaller charity’s mission to continue, within a stronger organisation

- Provides economies of scale and increased efficiency

- Expands the reach and resources of the larger charity.

3. Subsidiary Model

One charity becomes a ‘wholly owned’ subsidiary of another, while retaining its own identity.

Key characteristics:

- The subsidiary charity maintains its own board, but the parent has ultimate control

- Assets and operations of the subsidiary remain distinct

- The parent provides strategic direction and oversight.

Benefits:

- Allows the subsidiary to maintain its brand and donor relationships

- The parent can provide financial stability and resources

- Achieves some integration while preserving the subsidiary’s identity.

4. Group Structure

Multiple charities join together under a group structure, while maintaining separate identities.

Key characteristics:

- A parent/umbrella organisation is formed to oversee the new group

- Individual charities retain their own boards and some autonomy

- The individual charities share back-office functions and strategic alignment.

Benefits:

- Maintains distinct brands and fundraising bases

- Achieves some economies of scale through shared services

- Allows for gradual integration over time.

5. Asset Swap

Charities exchange specific assets or programmes, without fully merging.

Key characteristics:

- Charities trade particular assets, services, or operations

- Each charity maintains its overall independence

- Requires careful valuation of the assets being exchanged.

Benefits:

- Allows charities to focus on core strengths

- Can increase efficiency by consolidating similar programmes

- Less complex than a full merger.

It is important to have a general understanding of the characteristics of the various types of merger as there are clear benefits to each model. There is, of course, a lot more to consider in each case.

Next Steps:

We feel that the sooner you start thinking about merger and partnership the greater the chance of success.

We are here to help you wherever you are in the merger journey. Contact us for a free, completely confidential 30-minute advice session with one of our merger experts to discuss how to take the next steps.

Find out more about our charity and not-for-profit merger and partnership consultancy services.

While the Good Merger Guide is available for download, as this was originally created in 2014 it contains older case studies and references. Please refer to the latest Good Merger Index and our website merger topics section for our latest case studies, blogs, insights and other merger-related content.

Read the other articles in this charity merger series.